Table of Contents

- JPM Stock Price and Chart — NYSE:JPM — TradingView

- Tổng quan về cổ phiếu JPM: Tất cả những điều bạn cần biết về JPMorgan ...

- JPM Stock Price and Chart — NYSE:JPM — TradingView

- Why You Should Short JPM Stock And Go Long MS Stock | InvestorPlace

- JPM Stock Price Prediction: Will JP Morgan Stock Price Sustain ...

- JPM Stock Price and Chart — NYSE:JPM — TradingView

- Chart dan Harga Saham JPM — NYSE:JPM — TradingView

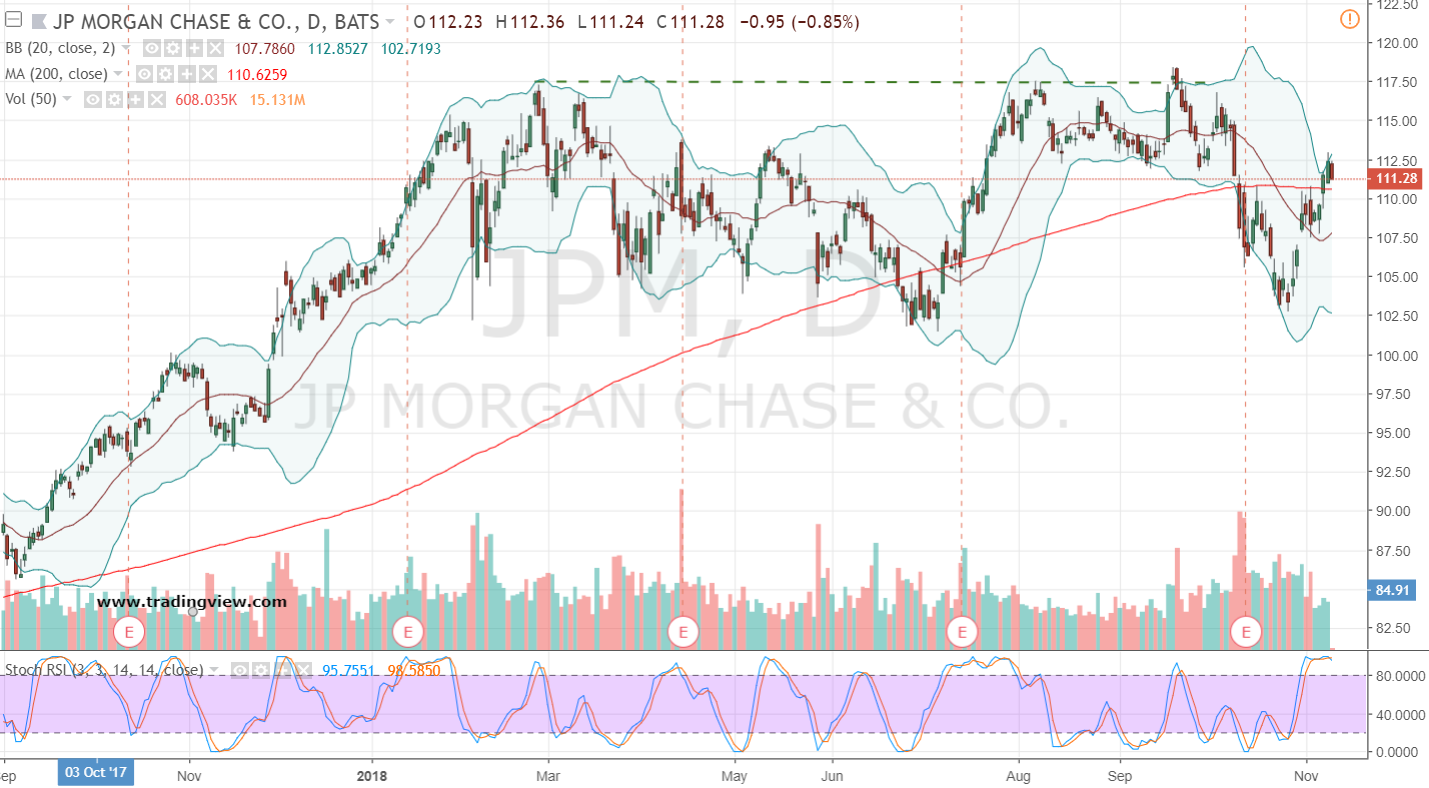

- JPM Stock Price Trend Source: Yahoo Finance [17] BRK/A is a ...

- JPM Stock: JPMorgan Stock Is Its Most Oversold Since 2009 | InvestorPlace

- Is JPMorgan Chase Stock a Buy in July? - Nasdaq.com

As one of the largest and most well-established financial institutions in the world, JPMorgan Chase & Co. (JPM) has consistently been a topic of interest for investors and financial analysts alike. In this article, we will delve into the current JPM stock price, its historical performance, and the factors that influence its stock quote on the New York Stock Exchange (NYSE).

Current JPM Stock Price and Performance

As of the latest trading session, the JPM stock price is $145.23, with a market capitalization of over $430 billion. The stock has shown a significant increase in value over the past year, with a 12-month return of 25.6%. This growth can be attributed to the company's strong financial performance, strategic acquisitions, and a favorable economic environment.

Historical Performance of JPM Stock

A review of the historical performance of JPM stock reveals a steady growth trend over the years. The stock has consistently outperformed the broader market, with an average annual return of 10.2% over the past five years. The company's strong brand reputation, diversified business model, and commitment to innovation have contributed to its long-term success.

Factors Influencing JPM Stock Quote

Several factors influence the JPM stock quote, including:

- Economic Conditions: The overall state of the economy, including interest rates, inflation, and employment rates, can impact JPM's stock performance.

- Regulatory Environment: Changes in financial regulations and government policies can affect the company's operations and profitability.

- Competitor Activity: The performance of rival banks and financial institutions can influence JPM's stock price.

- Company-Specific News: Earnings reports, mergers and acquisitions, and other company-specific events can impact investor sentiment and stock price.

Investment Opportunities and Risks

Investing in JPM stock offers several opportunities, including:

- Dividend Income: JPM has a history of paying consistent dividends, providing a regular income stream for investors.

- Long-Term Growth: The company's diversified business model and commitment to innovation position it for long-term growth and success.

However, as with any investment, there are also risks associated with JPM stock, including:

- Market Volatility: The stock market can be unpredictable, and JPM's stock price may fluctuate in response to market conditions.

- Regulatory Risks: Changes in regulations or laws can negatively impact the company's operations and profitability.

In conclusion, JPMorgan Chase & Co. (JPM) is a well-established financial institution with a strong track record of performance. The current JPM stock price reflects the company's solid financials, strategic acquisitions, and favorable economic environment. While there are risks associated with investing in JPM stock, the potential for long-term growth and dividend income make it an attractive option for investors. As with any investment, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Stay up-to-date with the latest JPM stock news and analysis to make informed investment decisions. Visit our website for more information on JPMorgan Chase & Co. and other stocks listed on the NYSE.