Table of Contents

- Fannie Mae November 18th 2024 - Adria Ardelle

- What's being considered for the former Fannie Mae site - Curbed DC

- Fannie Mae Corrects Its Title Insurance Pilot Program Mistake ...

- [webinar] How to adopt Fannie Mae’s Value Acceptance + Property Data ...

- Fannie Mae vs Freddie Mac vs Ginnie Mae | Finance Strategists

- Fannie Mae vs Freddie Mac vs Ginnie Mae | Finance Strategists

- What is Fannie Mae & Freddie Mac and How Do They Work? - Jackie Mack

- Fannie Mae Upgrades Data Validation Capabilities in Desktop Underwriter ...

- Fannie Mae: Εξακολουθεί να βλέπει μια... ύφεση να έρχεται - Radar.gr ...

- Donald Trump’s budget director’s Fannie Mae and Freddie Mac bill would ...

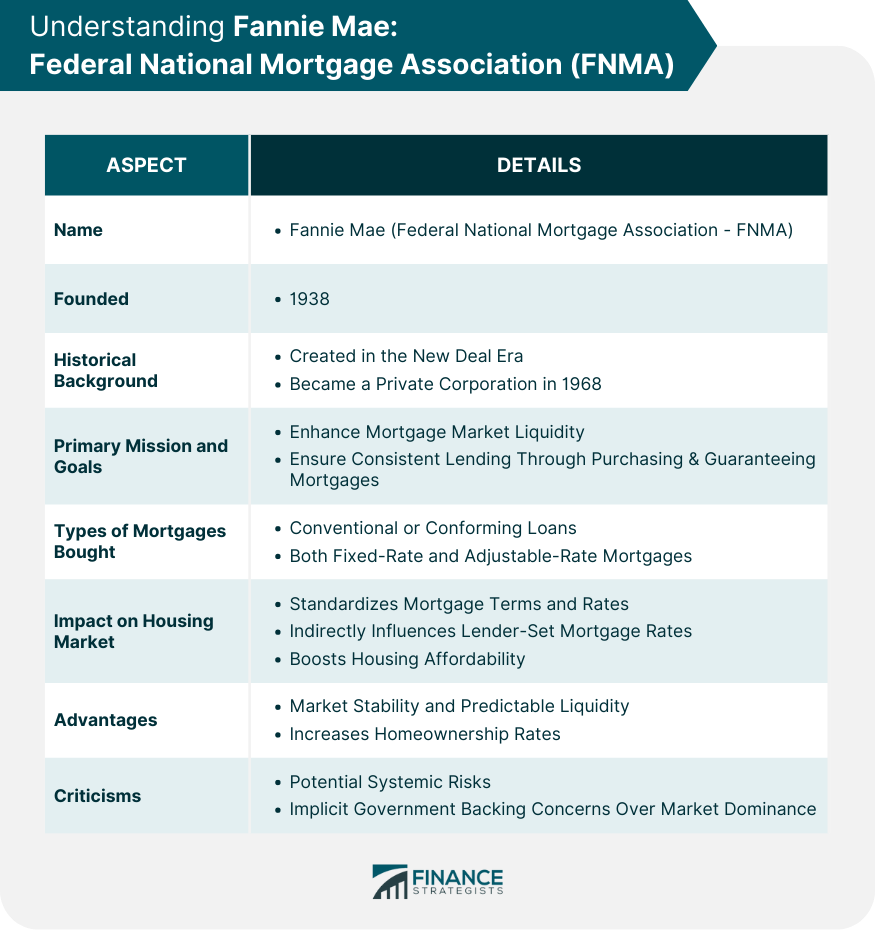

Fannie Mae, also known as the Federal National Mortgage Association (FNMA), is a government-sponsored enterprise (GSE) that plays a crucial role in the US mortgage market. As a leading provider of mortgage financing, Fannie Mae has been instrumental in making homeownership more accessible and affordable for millions of Americans. In this article, we will delve into the history, functions, and significance of Fannie Mae, as well as its impact on the US economy.

History of Fannie Mae

Fannie Mae was established in 1938 as part of President Franklin D. Roosevelt's New Deal program, aimed at stabilizing the US housing market during the Great Depression. Initially, the organization was tasked with providing liquidity to the mortgage market by purchasing and securitizing mortgages from lenders. Over the years, Fannie Mae has undergone significant transformations, including its conversion into a publicly traded company in 1968 and its takeover by the US government in 2008.

Functions of Fannie Mae

Fannie Mae's primary function is to provide liquidity to the mortgage market by purchasing and securitizing mortgages from lenders. The organization achieves this through various channels, including:

- Purchasing mortgages from lenders and packaging them into mortgage-backed securities (MBS)

- Providing financing to lenders through its credit facilities

- Offering mortgage insurance to protect lenders against default

- Developing and implementing affordable housing programs

Significance of Fannie Mae

Fannie Mae's role in the US mortgage market cannot be overstated. The organization's activities have a direct impact on the availability and affordability of mortgage credit, which in turn affects the overall health of the US economy. By providing liquidity to the mortgage market, Fannie Mae helps to:

- Keep mortgage interest rates low

- Increase access to credit for low- and moderate-income borrowers

- Support the development of affordable housing

- Stabilize the housing market during times of economic uncertainty

![[webinar] How to adopt Fannie Mae’s Value Acceptance + Property Data ...](https://www.clearcapital.com/wp-content/uploads/2023/07/Clear-Capital-Fannie-Mae-Webinar_post-square-1.jpg)

Impact on the US Economy

Fannie Mae's activities have a significant impact on the US economy. The organization's mortgage financing activities help to:

- Stimulate economic growth by increasing consumer spending and investment in the housing sector

- Create jobs in the construction and real estate industries

- Support the development of affordable housing, which helps to reduce poverty and income inequality

- Contribute to the overall stability of the US financial system

In conclusion, Fannie Mae plays a vital role in the US mortgage market, providing liquidity, affordability, and stability to the housing sector. As a government-sponsored enterprise, Fannie Mae's activities have a significant impact on the US economy, from stimulating economic growth to supporting affordable housing. As the US housing market continues to evolve, the importance of Fannie Mae's role will only continue to grow.

For more information on Fannie Mae and its activities, visit the Fannie Mae Wikipedia page. Whether you're a homeowner, lender, or simply interested in the US mortgage market, understanding the role of Fannie Mae is essential for making informed decisions and staying up-to-date on the latest developments in the industry.