Table of Contents

- What A New Chair Could Mean For The FDIC

- The FDIC’s Campaign Against Fintech Companies - WSJ

- Member FDIC. What Does that Mean for You As a Customer? - First ...

- FDIC Insurance: What Bank Products Are Covered & What's Not?

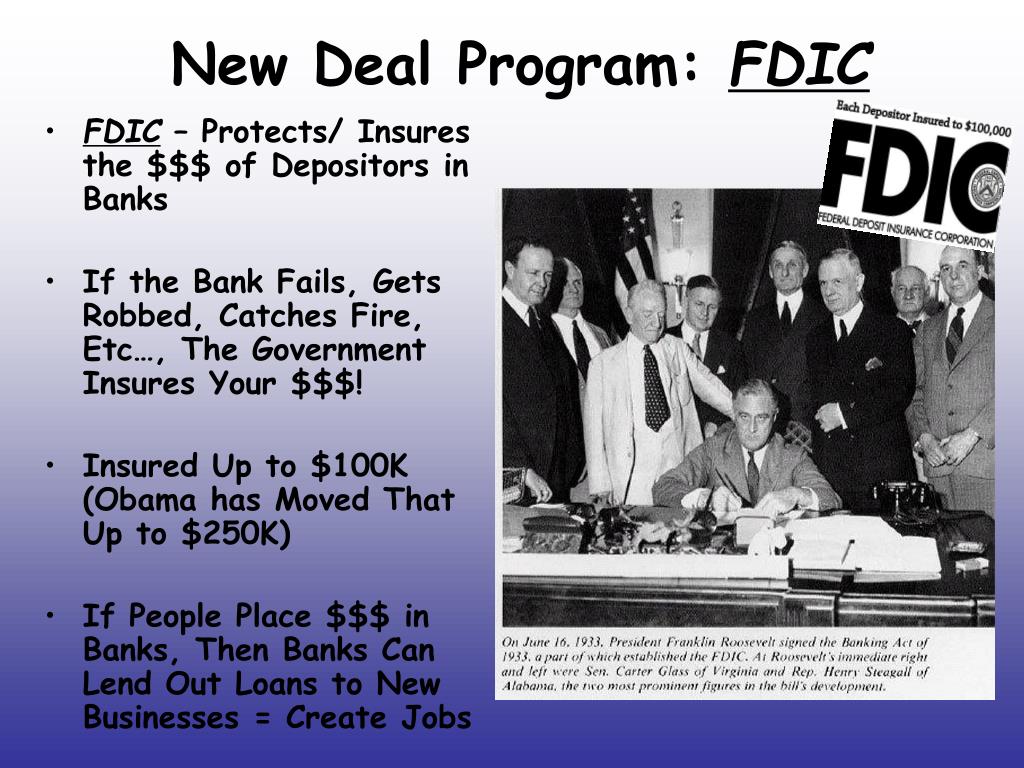

- PPT - Roosevelt & the New Deal PowerPoint Presentation, free download ...

- President Appoints New Inspector General of FDIC – The Presidential ...

- FDIC Vice Chairman: Basel III Endgame Needs Re-Proposal

- Deciphering Banking Acronyms: A Guide to Industry Lingo – Banking+

- Join us at the FDIC International trade show, April 15-20, 2024, in ...

- Events Leading to the Formation of the FDIC & the FDIC's Mission and ...

What is the Federal Deposit Insurance Corp. (FDIC)?

How Does FDIC Insurance Work?

FDIC Insurance Limits

The FDIC provides insurance coverage up to $250,000 per depositor, per insured bank. This means that if you have deposits in multiple accounts at the same bank, the total insurance coverage is $250,000. However, if you have deposits in multiple banks, each bank's deposits are insured separately, up to $250,000. For example, if you have $200,000 in a checking account at Bank A and $200,000 in a savings account at Bank B, both deposits are fully insured, as each bank's deposit is below the $250,000 limit.